Welcome to our Investor Relations Center

Over 2,000 companies have chosen innoscripta to safeguard their R&D investments.

The research grant is the perfect opportunity to financially support your innovations. innoscripta is your partner for a successful application. We support you from the application to the documentation .

Revolutionizing R&D Management

At innoscripta SE, we integrate cutting-edge technology with seamless R&D management processes to empower businesses worldwide. Our mission is to drive efficiency, foster innovation, and deliver exceptional value to our clients and stakeholders.

The innoscripta Effect

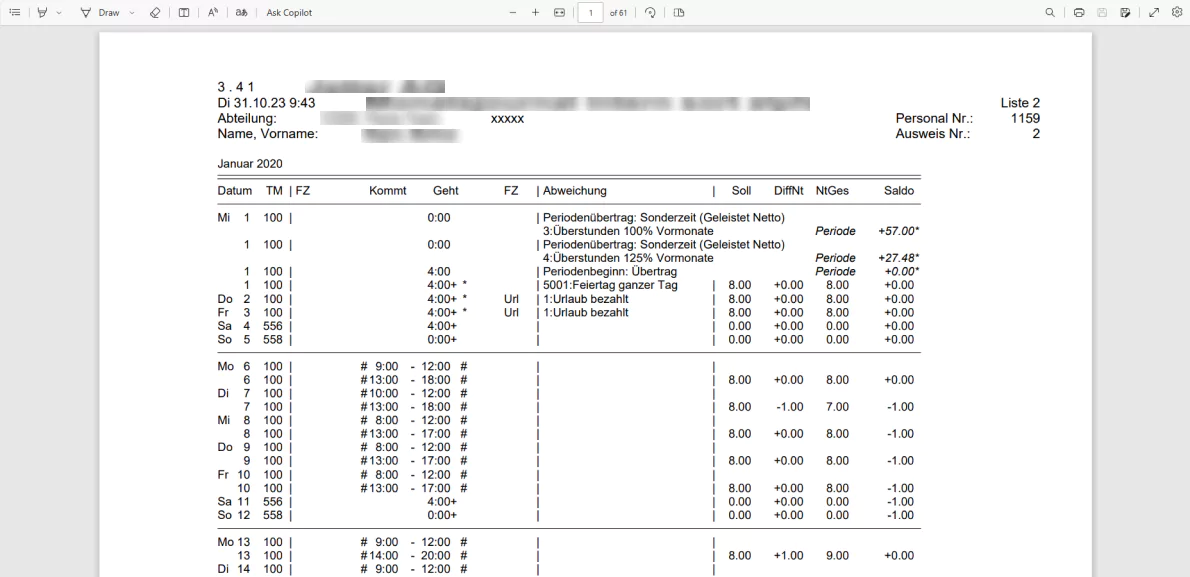

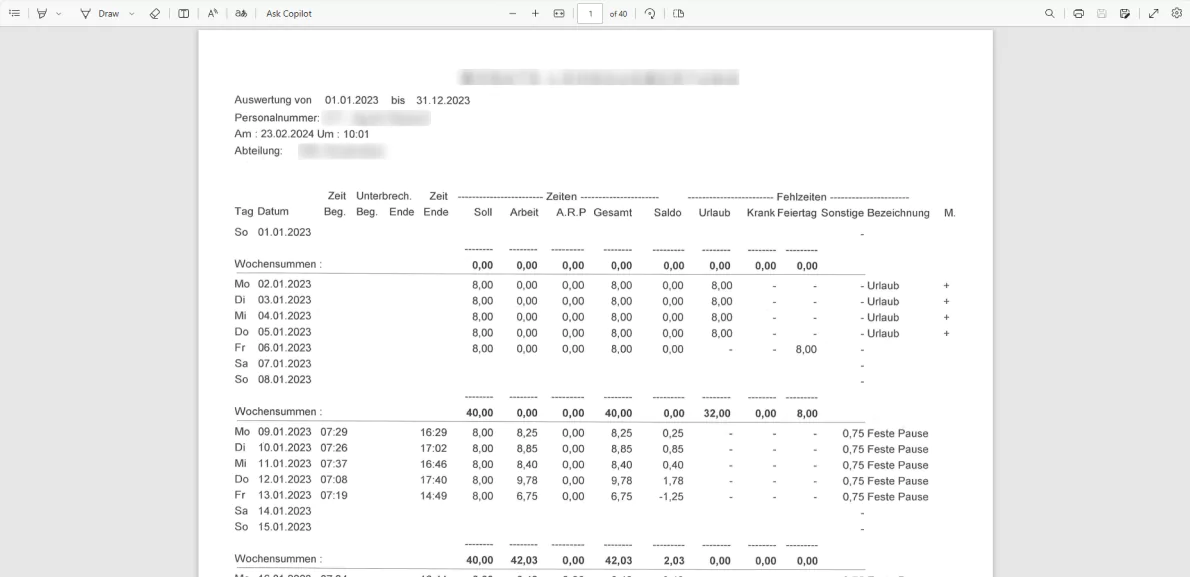

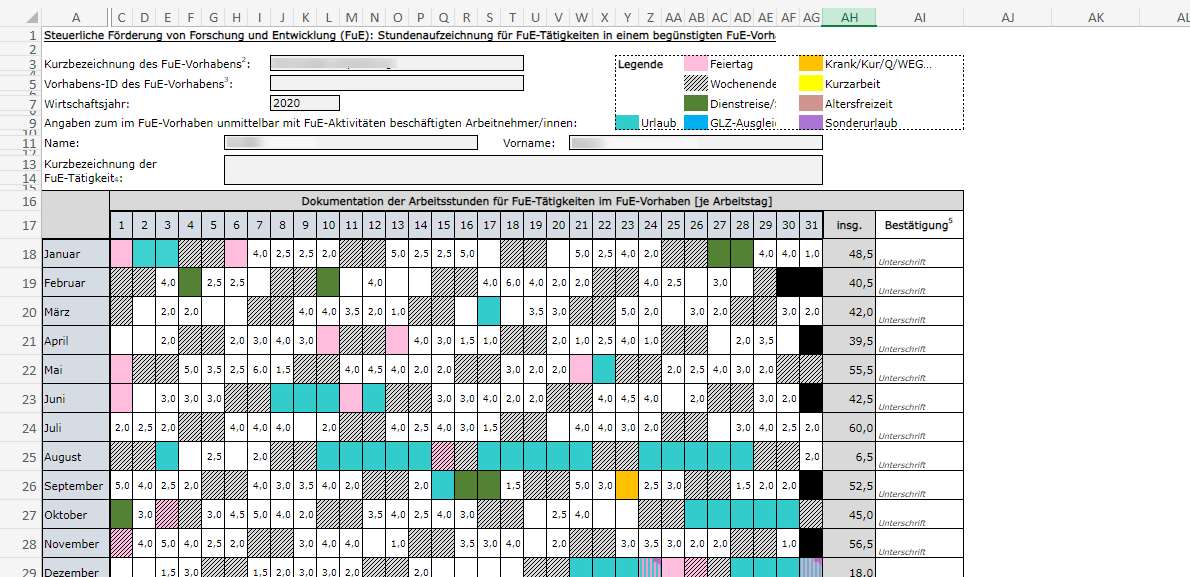

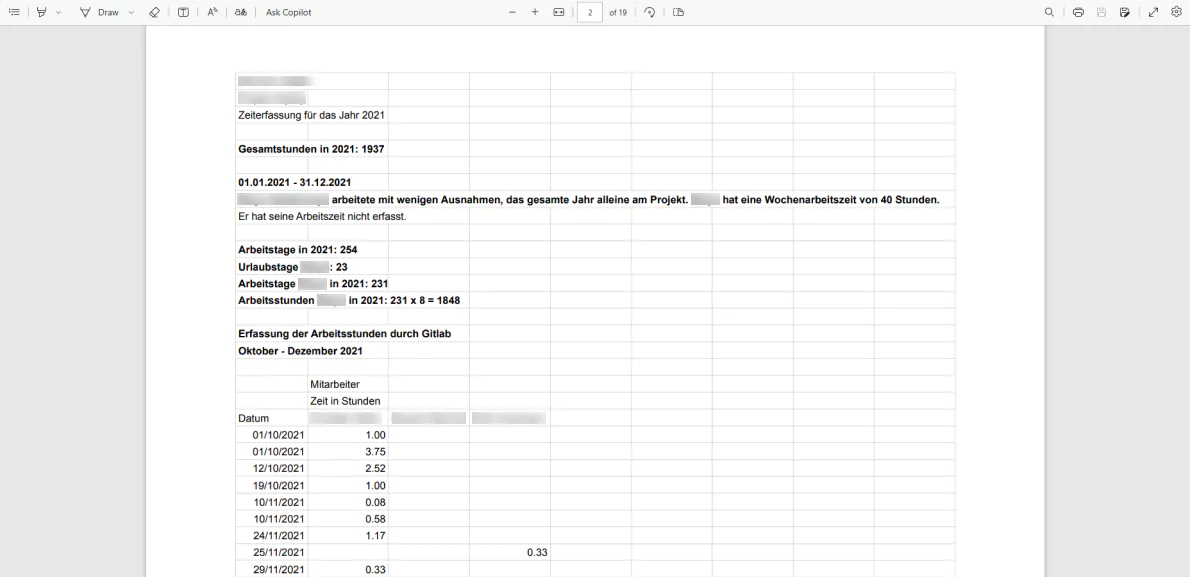

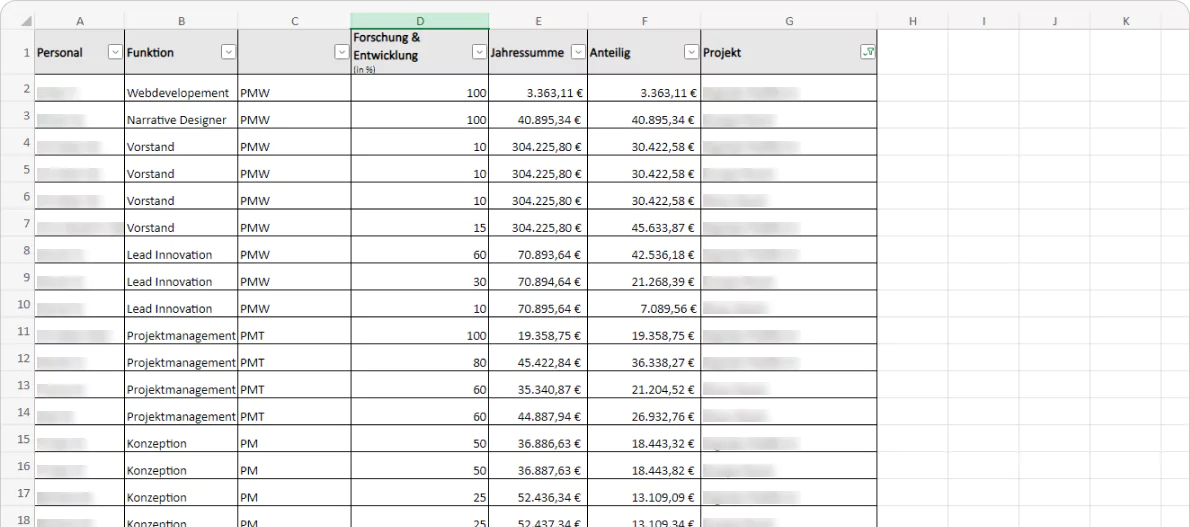

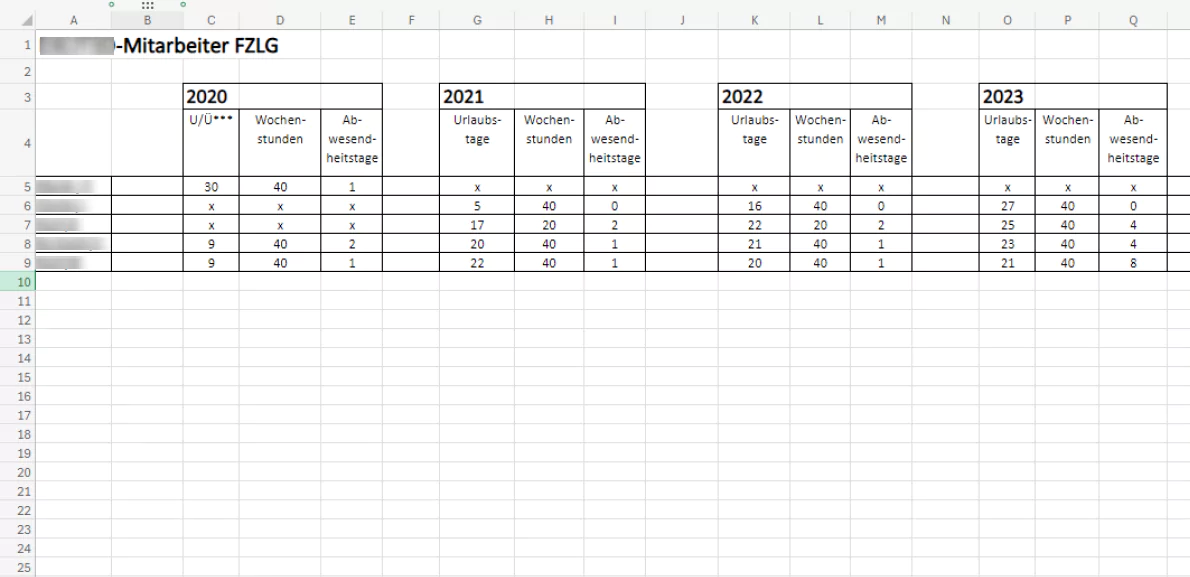

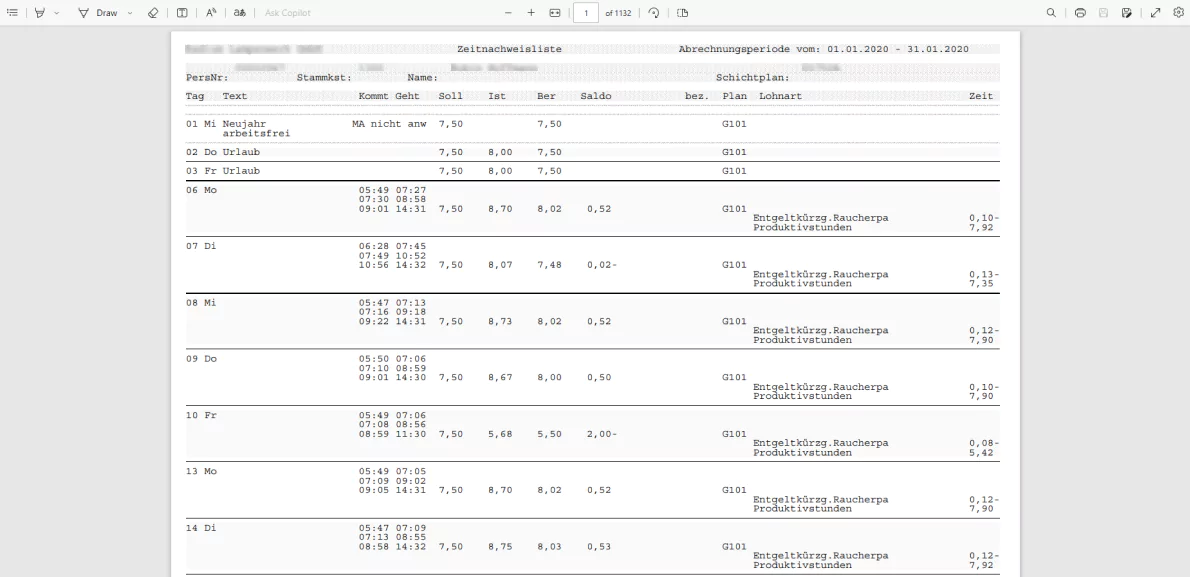

We receive complex and varied data from clients, which can be challenging and time-consuming to sort and organize.

Financial Calendar & Documents

What Do We Do?

We aim to revolutionize R&D management with a comprehensive software platform in an effort to replace tools like Excel, streamlining operations and simplifying the R&D tax grant application process. Our user-friendly solution enhances decision-making, optimizes resource allocation, and ensures compliance with audit-proof documentation and robust data security. Leveraging increasing government support for R&D, our platform drives efficiency, innovation, and competitive advantage by bridging the digital gap in R&D management, meeting the complex needs of clients across various sectors and geographies, and enabling them to capitalize on available incentives in a rapidly evolving market.

Introduction to Tax R&D Credits

and the Importance of Documentation

Tax R&D credits are government-provided fiscal incentives that reduce the financial burden on companies to encourage investment in innovation, thereby stimulating economic growth and technological advancements. Proper documentation of R&D expenses is essential to qualify for these credits, ensuring compliance, preventing fraud, and substantiating claims to avoid penalties and legal challenges.

There is a worldwide competition for R&D incentives. Countries do not want innovative companies to leave the country. Tax R&D credits are fiscal incentives provided by governments to encourage businesses to invest in research and development. These incentives can come in various forms such as allowances, exemptions, deductions, or credits, and they aim to reduce the financial burden on companies undertaking innovative projects. By lowering the cost of R&D, these tax credits stimulate economic growth, enhance productivity, and boost technological advancements.

Proper documentation of R&D expenses is crucial to qualify for these tax credits. It ensures traceability and transparency, preventing fraud and maintaining compliance with tax regulations. Accurate records allow companies to substantiate their claims and demonstrate that their R&D activities meet the necessary criteria. Without thorough documentation, companies risk facing compliance issues, potential penalties, and legal challenges during tax audits. Thus, maintaining detailed and organized records of R&D activities is essential to fully benefit from these tax incentives.

Increasingly Complex R&D Claims’ Requirements

Tax authorities now require more detailed documentation for R&D tax credit claims and have narrowed the definition of qualifying activities. Increased scrutiny and audits mean companies must keep meticulous records to defend their claims. Evolving legislation adds complexity by frequently updating eligibility and credit amounts. The OECD is standardizing R&D tax incentives across member nations to better support business-driven R&D, using research and data infrastructure like the Frascati Manual and the OECD R&D tax incentives database.

Substantiation requirements

Over the years, tax authorities have been requiring more detailed documentation to substantiate R&D claims.

Narrowing Definition

Definition of what qualifies as R&D is becoming more stringent, with tax authorities narrowing criteria

Reputation and Trust Issues

Tax authorities have increased their scrutiny of R&D tax credit claims, resulting in a higher likelihood of audits as a result of increasing frauds and errors

Evolving Legislation

Laws governing R&D tax credits are often updated, making compliance more complex.

One Platform, All Countries

We believe we are a leading provider of Software-as-a-Service R&D tax and R&D project management in Germany with our innoscripta Platform that integrates project management, time tracking and funding management. In a rapidly evolving market valued at over 100 billion euros, our innovative solutions and deep expertise in R&D tax credits help businesses optimize their efforts and achieve sustainable growth. Demonstrating significant financial growth and a strong market position, innoscripta is committed to delivering exceptional value and robust returns for our clients and stakeholders.

Meet the Board

Executive Board

Michael Hohenester is the Chief Executive Officer of the Company and was appointed to this position in December 2022. Michael founded innoscripta and became a member of the Management Board in 2012. Prior to this position, Michael founded Curefab GmbH in Munich and was the Chief Executive Officer of the company from 2009 to 2012. He holds a diploma degree from the Ludwig-Maximilians-University of Munich. Alongside his office as Chief Executive Officer of the Company, Michael is, or was within the last five years, a member of the administrative, management or supervisory bodies of/and or a partner of the following entities outside of innoscripta.

Alexander Meyer is Chief Executive Officer of the Company and was appointed to this position in December 2022. Alexander became a member of the Management Board in 2018. Prior to this Position, Alexander co-founded CONMATRA Pvt. Ltd. Alexander studied business administration at the University of Hamburg and the Ludwig-Maximilians-University in Munich. He also studied Management & Marketing at the Deakin University. Alongside his office as Chief Executive Officer of the Company, Alexander is, or was within the last five years, a member of the administrative, management or supervisory bodies of/and or a partner of the following entities outside of innoscripta.

Sebastian Schwertlein is Chief Operating Officer of the Company and was appointed to this position in December 2024. Sebastian became a member of the Management Board in December 2024. Prior to this position, Sebastian worked for the BMW Group. He started his career as a research assistant at the Technical University Munich. Sebastian studied at the Technical University of Munich and holds a Bachelor's and Master's degree in Mechanical Engineering. In addition to his position as a member of the Management Board of the Company, Sebastian is not and was not within the last five years, a member of the administrative, management or supervisory bodies of, and/or a partner of any entities outside of the Company.

Supervisory Board

Philipp von Ilberg is the Chairman of the Supervisory Board of innoscripta SE and was appointed to this position on August 5, 2024. Philipp is currently Managing Director of gesund arbeiten GmbH. Philipp is also Managing Director of Mayer Sitzmöbel Verwaltungs-GmbH, which acts as the personally liable partner of Mayer Sitzmöbel GmbH & Co. KG in Redwitz, Germany. Prior to this position, Philipp worked as a lawyer at McDermott Will & Emery Rechtsanwälte Steuerberater LLP from 2012 to 2017, where he was managing partner of the Frankfurt office, and at Dewey & LeBoeuf LLP from 2003 to 2012, where he was also managing partner of the Frankfurt office. Philipp began his career at the Frankfurt office of Clifford Chance LLP, where he worked from 1997 to 2003. He also worked in the corporate finance department of Deutsche Bank AG in Frankfurt from 1993 to 1995. Philipp studied law at the University of Erlangen and Ludwig Maximilian University in Munich. He also completed a banking apprenticeship at BHF Bank in Frankfurt.

Christoph Möller is member of the Supervisory Board of the Company and was appointed to this position on June 2, 2023. On August 20 2024, Christoph was appointed as deputy Chairman of the Supervisory Board of the Company. Christoph specializes in international business law and is particularly focused on foreign investment in Latin American markets. In addition to his admission as an attorney in Germany, Christoph is also admitted as an attorney in Colombia. Since 2016, he serves as an independent lawyer, running his own law firm in the city of Medellín, Colombia, specialized in legal advice on foreign investments and international expansions in the Colombian market. Christoph studied law at Ludwigs-Maximilians-University Munich and Université Paris II (Panthéon-Assas) and holds a law degree from the Ludwig-Maximilians-University Munich.

Stefan Berndt-von Bülow is member of the Supervisory Board of the Company and was appointed to this position on August 5, 2024. Stefan currently serves as CFO at Ads-Tec Energy PLC. Prior to this position, Stefan worked as Head of Finance, Controlling and Legal at Mynaric AG from 2018 to 2020 and as CFO from 2020 to 2024. His previous experience includes the role of Head of Finance and Accounting at Giesecke+Devrient Currency Technology GmbH in Munich from 2017 to 2018. Stefan also worked as Head of Accounting, Investor Relations, Director of the subsidiary at SHS VIVEON GmbH and Member of the Executive Board of SHS VIVEON AG in Munich from 2008 to 2017. Stefan started his career at LKC Kemper, Czarske, v. Gronau, Berz Wirtschaftsprüfer Rechtsanwälte Steuerberater in Grunwald/Munich, working there from 2002 to 2008. Stefan studied Business Administration Studies at the Ludwig-Maximilians-University Munich.

Dr. Erik Massmann is a member of the Supervisory Board of the company and was appointed to this position on November 5, 2024. He was appointed Chief Financial Officer of the BIRKENSTOCK Group in 2023 and was responsible for finance and human resources at the BIRKENSTOCK Group until January 31, 2025. He has over 30 years of professional experience in finance related positions, including more than 20 years as chief financial officer in various companies and industries. Erik started his career in the corporate finance department of DG Bank AG. After being appointed as Chief Financial Officer of the software company IBS AG in 2001, he joined CompuGroup Medical AG in 2003 and served as Chief Financial Officer until 2009, with responsibility for finance, corporate controls, human resources and investor relations. He led CompuGroup´s initial public offering process in 2007. After leaving CompuGroup, he started at Personal&Informatik AG and worked there until 2010 at which time he joined Sportradar AG in 2014, a sports technology company. In 2020, Erik was appointed chief financial officer of the online fashion brand Oceans Apart, before joining BIRKENSTOCK in November 2022 as finance director for BIRKENSTOCK Europe. Erik graduated with a Diploma in Economics and Political Science from the Freie Universität Berlin, where he also received his Doctorate in the same field in 2003.

Duygu serves as Teamlead Human Resources at innoscripta since 2021 and she was appointed to the Supervisory Board on November 5, 2024. Prior to that she worked for Transporeon GmbH in Ulm as an assistant to the Chief Compliance Officer in 2021. Duygu previously worked as a working student in the human resources department at Transporeon GmbH in Ulm from 2020 to 2021. Duygu also worked as a bachelor student in corporate social responsibility (CSR) at Alois Kober GmbH in Kötz in 2018. She was also previously an intern in marketing at Alois Kober GmbH in Kötz in 2018. Before that she was a sales and marketing assistant at Oberstdorf Event GmbH from 2014 to 2015. Duygu holds a Bachelor's degree in Information Management and Corporate Communications from Neu-Ulm University of Applied Sciences. She also completed vocational training as an office administrator from 2011 to 2014.

Prof. Dr. Kai C. Andrejewski is member of the Supervisory Board of the Company and was appointed to this position on November 5, 2024. Kai currently serves as a Member of the Supervisory Board and Chairman of the Finance Committee at SEEHG Securing Energy für Europe Holding GmbH in Berlin. He also serves as a Member of the Supervisory Board and Chairman of the Audit Committee at Deutsche Beteiligungs AG in Frankfurt am Main. On November 1, 2024, he became Managing Partner of Agora Strategy Group AG in Munich. Prior to these positions, Kai worked as Chief Financial Officer at SIXT SE in Pullach from 2021 to 2024. Previously, he was Managing Partner South Region at KPMG AG Wirtschaftsprüfungsgesellschaft in Munich from 2016 to 2021 and Managing Partner West Region at KPMG AG Wirtschaftsprüfungsgesellschaft in Dusseldorf from 2012 to 2016. Before that Kai worked at KPMG AG Wirtschaftsprüfungsgesellschaft in Munich from 2010 to 2011. He also worked from 2007 to 2010 for KPMG Audit France SAS as Head of International German Desk in Paris. Prior to this position, Kai worked at KPMG Deutsche Treuhandgesellschaft AG in Munich from 2005 to 2007 and for KPMG Deutsche Treuhandgesellschaft AG as Partner in the IFRS Policy Department in Berlin from 2002 to 2005. Kai worked in the past at Arthur Andersen LLP as Senior Manager in Paris and Chicago from 2001 to 2002 and for Arthur Andersen GmbH as Audit Manager in Hamburg from 1998 to 2001. Kai started his career at Coopers & Lybrand Westdeutschland AG in Essen, working there from 1993 to 1998. Kai holds a degree in business administration from the Georg-August University of Göttingen, where he graduated in 1993. He is also a certified tax advisor (Steuerberater) and certified public auditor (Wirtschaftsprüfer). In addition, he received his doctorate from the University of Ulm in 2006 and was appointed professor at the PFH Göttingen in 2011 with a research focus on accounting, sustainability and business ethics.

Performance Factors

We create R&D transparency with our all-in-one, user-friendly software. Our strategy focuses on innovation, sustainability, and growth. We leverage expertise and technology to add value, while committing to environmental and social responsibility. Our goals include expanding market presence, enhancing products, and improving efficiency.

Gross domestic R&D spend in OECD (2022)

R&D spend CAGR in OECD (2022-2030)

R&D tax credit software(2)

Signed customers(1)

Average contract duration (most of which auto-renewed)

Churn rate(3)

EBIT (2024A)

EBIT CAGR (2022A-2024A)

EBIT margin (2024A)

Note(s): (1) As of December 2024; (2) Based on the Company's experience with market participants; (3) Refers to the 2022-2024 period. Customer churn rate refers to number of customers contracts terminated divided by the sum of the existing and newly signed customer contracts in the respective year. Source(s): OECD, Gross domestic spending on R&D (2022), converted using EUR/ USD FX Rate of $1.11; OECD, Main Science and Technology Indicators